Top Factors That Affect Your Homeowners Insurance Quote sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality. From the impact of home location to the importance of construction materials, this guide delves deep into the factors that influence your insurance costs.

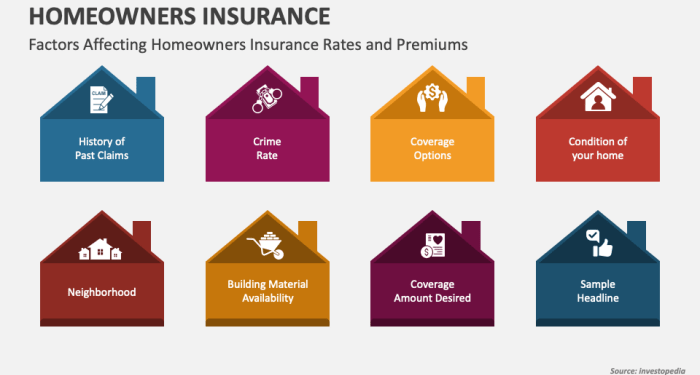

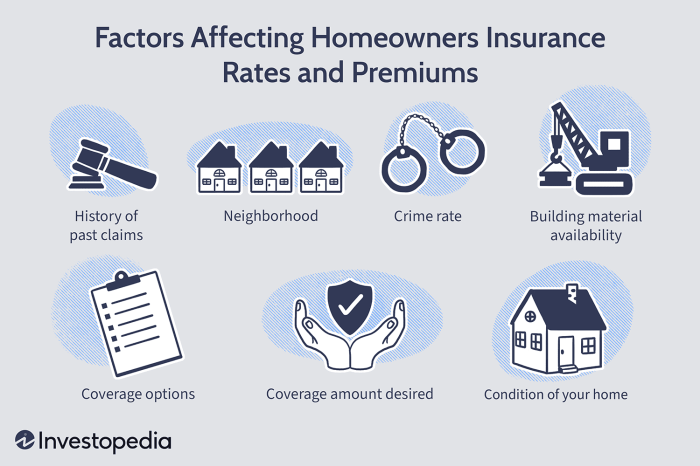

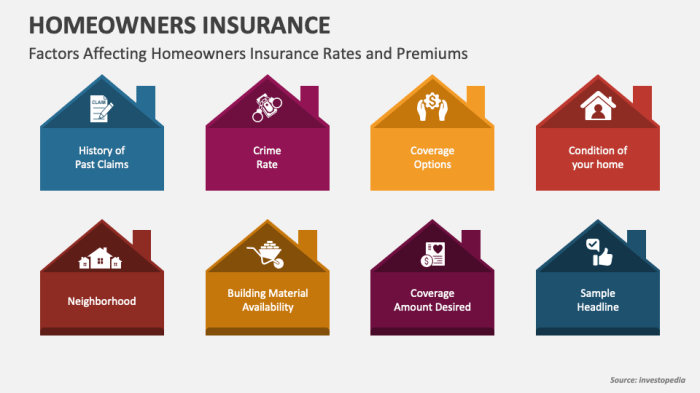

Factors that Determine Homeowners Insurance Quote

When it comes to calculating homeowners insurance quotes, insurance companies take various factors into consideration to determine the cost. These factors play a crucial role in assessing the level of risk associated with insuring a particular home.

Location

The location of your home is a significant factor that insurance companies consider when determining your insurance quote. Homes located in areas prone to natural disasters such as hurricanes, earthquakes, or wildfires may have higher insurance premiums due to the increased risk of damage.

Home Value

The value of your home is another essential factor that impacts your insurance costs. A more expensive home will generally have higher insurance premiums since it would cost more to repair or replace in case of damage.

Construction Materials

The materials used to construct your home can also affect your insurance quote. Homes built with fire-resistant materials like brick or stone may qualify for lower insurance premiums compared to those made with wood, which is more susceptible to fire damage.

Age of the Home

The age of your home is a key factor in determining your insurance costs. Older homes may have outdated electrical or plumbing systems, which could increase the risk of damage and lead to higher insurance premiums.

Security Features

Having security features such as deadbolt locks, alarm systems, and smoke detectors can help lower your insurance premiums. These features reduce the risk of theft, vandalism, and fire damage, making your home less risky to insure.

Proximity to Fire Stations

The distance of your home from the nearest fire station can also impact your insurance costs. Homes located closer to fire stations are considered lower risk since firefighters can respond faster in case of a fire, potentially leading to lower insurance premiums.

Impact of Home Location on Insurance Quote

The location of a home plays a crucial role in determining homeowners insurance quotes. Insurers consider various factors related to the property's location to assess the risks involved and calculate appropriate premiums.Areas that are prone to natural disasters such as hurricanes, earthquakes, or tornadoes are considered high-risk zones by insurance companies.

Homes located in these areas are more likely to suffer damage, leading to increased insurance costs. Similarly, regions with high crime rates are also categorized as high-risk areas, resulting in higher premiums to offset the potential risk of theft or vandalism.Proximity to water bodies, flood zones, or wildfire-prone areas can significantly impact insurance costs.

Homes located near rivers, lakes, or coastal areas are at a higher risk of flooding, while properties in wildfire-prone regions face the danger of fire damage. As a result, insurers adjust premiums accordingly to account for these specific risks associated with the property's location.

Home Value and Insurance Premiums

When it comes to homeowners insurance, the value of your home plays a significant role in determining the cost of your premiums. Insurance companies use the value of your home as one of the key factors in assessing the risk associated with insuring your property.Higher home values typically result in increased insurance premiums.

This is because more valuable homes generally cost more to repair or replace in the event of damage or loss. Insurance companies take into account the potential financial risk they face when insuring a higher-value property, which is reflected in the premiums you pay

Impact of Home Value on Insurance Costs

Luxury features or upgrades in your home can also impact insurance costs. For example, if you have high-end finishes, expensive appliances, or other luxury amenities, the cost of repairing or replacing these items in case of damage can be higher.

As a result, insurance companies may adjust your premiums to account for the added value of these features.In addition, a higher home value may indicate a larger property with more square footage, which can increase the overall replacement cost. This, in turn, can lead to higher insurance premiums to ensure that your policy adequately covers the full value of your home.Overall, the relationship between home value and insurance premiums is clearthe more valuable your home, the higher your insurance premiums are likely to be.

It's essential to accurately assess the value of your home when purchasing homeowners insurance to ensure you have adequate coverage in place.

Importance of Home Construction Materials

When it comes to homeowners insurance, the materials used in home construction play a significant role in determining insurance quotes. Different construction materials can impact insurance premiums in various ways, affecting the overall cost of insuring your home.

Wood vs. Brick Construction

The type of construction material used in your home, such as wood or brick, can have a direct impact on your insurance premiums. Generally, homes made of brick or stone are considered more durable and fire-resistant compared to wood-framed homes.

As a result, homes constructed with brick or stone may qualify for lower insurance premiums due to the reduced risk of fire damage.

Roofing Materials

The roofing materials used in your home also play a crucial role in determining insurance costs. For example, homes with impact-resistant roofing materials like metal or asphalt shingles may be eligible for discounts on insurance premiums. These materials are more resilient to damage from hail, wind, and other weather-related hazards, reducing the risk of costly insurance claims.

Quality of Construction and Materials

In addition to the type of construction material, the overall quality of construction and materials used in your home can impact insurance costs. High-quality materials and construction techniques can enhance the durability and safety of your home, reducing the likelihood of damage from various perils.

As a result, homes built with superior materials and craftsmanship may qualify for lower insurance premiums due to the decreased risk of claims.

Final Conclusion

In conclusion, understanding the top factors that affect your homeowners insurance quote is crucial in making informed decisions about your coverage. By considering aspects such as home value, location, and construction materials, you can navigate the insurance landscape with confidence.

Stay informed, stay protected.

FAQ Section

What role does the age of my home play in determining insurance costs?

The age of your home can impact insurance costs as older homes may have outdated systems that pose higher risks.

How do security features affect homeowners insurance quotes?

Homes with security features like alarm systems or deadbolts may qualify for discounts on insurance premiums.

Is proximity to fire stations a significant factor in insurance costs?

Living near a fire station can reduce insurance costs due to quicker response times in case of emergencies.