Delving into Homeowners Insurance Quote Explained: What You’re Really Paying For, this introduction immerses readers in a unique and compelling narrative, with casual formal language style that is both engaging and thought-provoking from the very first sentence.

Exploring the intricacies of homeowners insurance quotes reveals the true essence of what policyholders are investing in, shedding light on the various components and factors that dictate the costs involved.

Understanding Homeowners Insurance Quote

When you receive a homeowners insurance quote, it's important to understand what you're paying for and how the cost is determined. Let's break down the components, factors that influence the cost, and different types of coverage included in a homeowners insurance quote.

Components of a Homeowners Insurance Quote

Here are the key components typically included in a homeowners insurance quote:

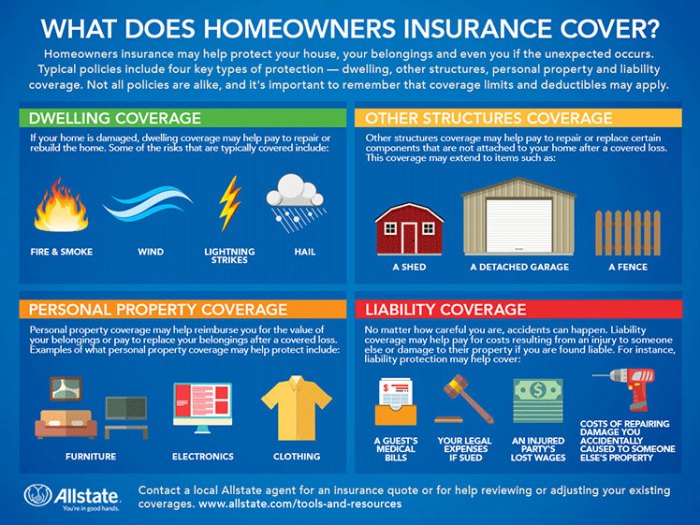

- Property coverage: This protects your home and other structures on your property in case of damage from covered perils like fire, theft, or vandalism.

- Liability coverage: This provides protection if someone is injured on your property and decides to sue you for damages.

- Personal property coverage: This covers your belongings inside your home, such as furniture, electronics, and clothing, in case of damage or theft.

- Additional living expenses coverage: If your home becomes uninhabitable due to covered damage, this coverage helps pay for temporary living arrangements.

Factors Influencing the Cost of a Homeowners Insurance Quote

Several factors can influence the cost of your homeowners insurance quote, including:

- Location: The area where your home is located can impact the risk of natural disasters or crime, affecting your premium.

- Home value: The value of your home and its contents will determine how much coverage you need, affecting the cost.

- Claims history: If you have made previous insurance claims, it can impact your premium as insurers may see you as a higher risk.

- Deductible amount: Choosing a higher deductible can lower your premium, but you'll pay more out of pocket in case of a claim.

Types of Coverage in a Homeowners Insurance Quote

There are different types of coverage included in a homeowners insurance quote, such as:

- HO-1: Basic form coverage that protects against specific named perils.

- HO-3: The most common type of coverage that protects your home and belongings against a wide range of perils.

- HO-5: Comprehensive coverage that offers broader protection for your home and belongings.

- HO-6: Coverage for condominium owners that protects the interior of the unit and personal property.

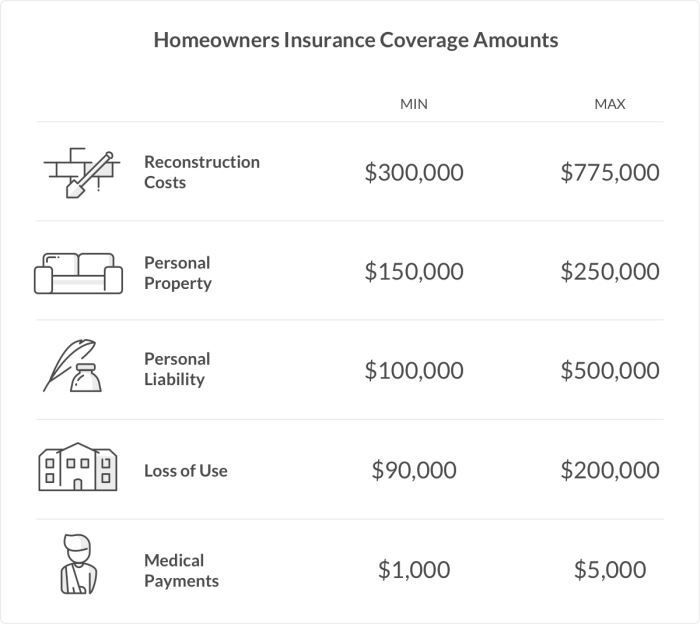

Coverage Breakdown

Homeowners insurance typically includes several standard coverages to protect your property and assets in case of unexpected events. These coverages are essential to provide financial security and peace of mind to homeowners.

Standard Coverage

- Dwelling Coverage: This covers the structure of your home in case of damage from covered perils such as fire, wind, or vandalism.

- Personal Property Coverage: Protects your belongings inside the home, including furniture, appliances, and clothing, from covered perils.

- Liability Coverage: Offers financial protection if someone is injured on your property and decides to sue you.

- Additional Living Expenses Coverage: Helps cover the costs of temporary housing and living expenses if your home becomes uninhabitable due to a covered event.

Additional Coverage Options

- Flood Insurance: Protects your home and belongings from flood damage, which is not covered under standard homeowners insurance.

- Earthquake Insurance: Covers damage to your home caused by earthquakes, which is also typically excluded from standard policies.

- Jewelry or Valuable Items Coverage: Provides higher coverage limits for expensive items such as jewelry, art, or collectibles.

Coverage Limits Impact

The coverage limits you choose for each type of coverage in your homeowners insurance policy directly impact the cost of your premium. Higher coverage limits mean more financial protection but also result in higher premiums. It's essential to carefully assess your coverage needs and strike a balance between adequate protection and affordability.

Premium Calculation

When it comes to homeowners insurance, the premium you pay is calculated based on several factors. Insurance companies take into account the risk associated with insuring your home, as well as the coverage limits you choose. Understanding how premiums are calculated can help you make informed decisions when selecting a policy.One key factor that influences your premium is the replacement cost of your home

This is the amount it would cost to rebuild your home from scratch if it were completely destroyed. The higher the replacement cost, the higher your premium is likely to be. Other factors that can affect your premium include the age and condition of your home, its location, and the materials used in its construction.

Discounts

- Insurance companies often offer discounts to homeowners who take steps to reduce the risk of damage to their homes. For example, you may be eligible for a discount if you have security alarms, smoke detectors, or fire extinguishers installed in your home.

- Another common discount is the multi-policy discount, which you may qualify for if you purchase both your homeowners and auto insurance from the same company.

- Some insurers also offer discounts to homeowners who have made upgrades to their homes, such as installing a new roof or upgrading their plumbing and electrical systems.

Deductibles

- Your deductible is the amount you agree to pay out of pocket before your insurance coverage kicks in. A higher deductible typically means a lower premium, as you are assuming more of the risk yourself.

- It's important to choose a deductible that you can comfortably afford in the event of a claim. While a higher deductible can save you money on your premium, it's essential to strike a balance between cost savings and financial security.

- Keep in mind that your deductible will apply each time you file a claim, so consider how often you are likely to make a claim when choosing your deductible amount.

Exclusions and Limitations

When it comes to homeowners insurance, it's essential to understand the exclusions and limitations of your policy. These details can significantly impact the coverage you receive in certain situations. Let's take a closer look at common exclusions, limitations, and optional endorsements that can enhance your homeowners insurance coverage.

Common Exclusions in Homeowners Insurance Policies

- Earth Movement: Most standard policies do not cover damages caused by earthquakes, landslides, or sinkholes.

- Floods: Coverage for flood damage is usually not included and requires a separate flood insurance policy.

- Wear and Tear: Damage resulting from lack of maintenance or normal wear and tear is typically not covered.

- Neglect: If your home suffers damage due to neglect or lack of proper upkeep, the insurance may not cover it.

Limitations of Standard Homeowners Insurance Coverage

- Limits on Valuables: Standard policies have limits on coverage for expensive items like jewelry, art, and electronics.

- Liability Limits: There are limits on liability coverage, which may not be sufficient in case of a lawsuit or claim against you.

- Actual Cash Value: Some policies only pay the actual cash value of damaged items, taking depreciation into account.

- Loss of Use: Coverage for additional living expenses if you have to temporarily move out of your home may be limited.

Optional Endorsements to Enhance Coverage

- Flood Insurance Endorsement: Adding flood coverage to your policy can protect your home from flood-related damages.

- Personal Property Endorsement: This endorsement can increase coverage limits for valuable personal belongings.

- Umbrella Liability Insurance: An umbrella policy provides additional liability coverage beyond the limits of your standard homeowners policy.

- Sewer Backup Endorsement: This endorsement covers damages caused by sewer backups, which are not typically included in standard policies.

Epilogue

In conclusion, understanding the breakdown of homeowners insurance quotes offers a transparent view of the coverage provided and the financial implications it carries. By unraveling the complexities of premiums, coverage options, and policy limitations, individuals can make informed decisions to safeguard their homes effectively.

Question Bank

What factors can influence the cost of a homeowners insurance quote?

Factors like location, home value, and chosen coverage limits can impact the overall cost of a homeowners insurance quote.

Are there discounts available to reduce premium costs?

Insurance companies may offer discounts for factors like bundling policies, having a security system, or being claims-free.

What are common exclusions in homeowners insurance policies?

Common exclusions can include damage from floods or earthquakes, as these often require separate coverage.

How do deductibles affect the premium amount?

Higher deductibles typically result in lower premiums, as policyholders agree to pay more out of pocket before insurance coverage kicks in.