Delving into the importance of reviewing your life insurance quote annually, this guide aims to shed light on why this practice is essential for your financial well-being. As life constantly evolves, so do your insurance needs, making it crucial to stay informed and proactive.

Exploring the factors to consider, benefits of comparing quotes, and tips for maximizing the value of your policy, this guide equips you with the knowledge to make informed decisions regarding your life insurance coverage.

Importance of Reviewing Your Life Insurance Quote Annually

Reviewing your life insurance quote every year is crucial to ensure that you have adequate coverage that meets your current needs. Life is dynamic, and changes can occur that may impact your insurance requirements.

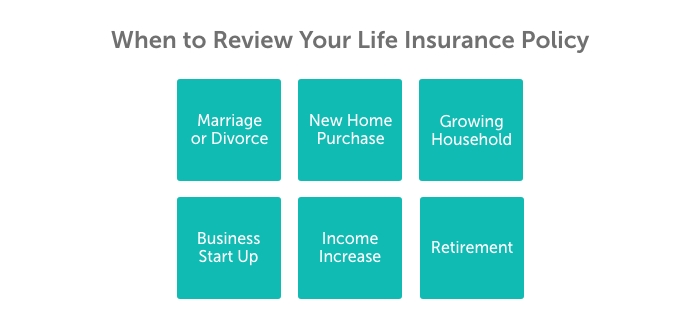

Potential Changes in Your Life

Life events such as marriage, having children, buying a home, or changing jobs can significantly impact your financial responsibilities and the amount of coverage you need. By reviewing your life insurance quote annually, you can make adjustments to reflect these changes and ensure that your loved ones are adequately protected.

Ensuring Adequate Coverage

- Reviewing your life insurance quote annually allows you to assess whether the coverage amount is still sufficient to provide financial stability for your family in case of your untimely death.

- Changes in your health or lifestyle may also affect your insurability or premium rates. By reviewing your quote, you can address any necessary updates or modifications to your policy.

- Comparing quotes from different insurers annually can help you find better rates or more comprehensive coverage options that suit your current needs and budget.

Factors to Consider When Reviewing Your Life Insurance Quote

Life is ever-changing, and so are your insurance needs. It's essential to review your life insurance quote annually to ensure that your coverage aligns with your current situation. Here are some key factors to consider during your review:

Health Changes

- Any changes in your health status should be taken into account during your review. For example, if you have developed a new medical condition or if your existing health has deteriorated, you may need to adjust your coverage accordingly.

- Improvements in your health, such as quitting smoking or losing weight, could potentially lower your premiums. It's important to inform your insurer of any positive changes in your health to see if you qualify for better rates.

Income Adjustments

- Your income plays a significant role in determining how much life insurance coverage you need. If your income has increased or decreased significantly since your last review, it's essential to adjust your coverage to ensure your loved ones are adequately protected in case of unforeseen events.

- Consider any changes in your financial obligations, such as taking on a new mortgage or sending a child to college, when evaluating your insurance needs.

Family Size

- Changes in your family size, such as getting married, having children, or becoming empty nesters, can impact your life insurance needs. Make sure to update your coverage to reflect these changes and ensure that your beneficiaries are adequately provided for.

- Consider the financial impact of caring for dependents or ensuring your spouse can maintain their lifestyle in your absence when reassessing your coverage.

New Life Events

- Any significant life events, such as buying a new home, starting a business, or getting a divorce, may warrant adjustments to your life insurance coverage. It's crucial to review your policy after such events to make sure your coverage is still sufficient.

- Life changes can impact your financial situation and the needs of your loved ones. Keep your insurer informed of any major life events to ensure that your policy adequately protects your family.

Benefits of Comparing Quotes from Different Providers

When it comes to life insurance, obtaining quotes from multiple providers can offer various benefits that can help you make an informed decision about your coverage.

Advantages of Obtaining Multiple Quotes

- Access to a Variety of Options: By comparing quotes from different insurance companies, you can explore a wide range of coverage options and premium rates.

- Potential for Cost Savings: Comparing quotes allows you to identify providers offering lower premiums for the same coverage, potentially saving you money in the long run.

- Customized Coverage: Different insurance companies may offer unique policy features or riders that better suit your individual needs and preferences.

Finding Better Coverage or Lower Premiums

Comparing quotes can help you find better coverage by evaluating the extent of protection offered by each policy. It also allows you to identify opportunities for cost savings by choosing a provider with lower premiums.

Importance of Reviewing Policy Details

- Policy Terms and Conditions: By comparing quotes, you can review the specific terms and conditions of each policy to ensure they align with your expectations and requirements.

- Exclusions and Limitations: Understanding the exclusions and limitations of each policy is crucial to avoid surprises in the event of a claim. Comparing quotes helps you identify any potential gaps in coverage.

- Financial Strength of Providers: Evaluating the financial stability and reputation of different insurance companies is essential to ensure they can fulfill their obligations in the future.

Tips for Maximizing the Value of Your Life Insurance Policy

Life insurance is a crucial financial tool that provides security and peace of mind for you and your loved ones. To maximize the value of your life insurance policy, consider the following strategies and tips:

Optimizing Your Life Insurance Coverage

- Regularly reassess your coverage needs based on your current financial situation, family dynamics, and future goals.

- Consider increasing your coverage if you have experienced major life changes such as marriage, having children, or purchasing a home.

- Ensure that your policy adequately covers outstanding debts, mortgage payments, and future expenses like college tuition for your children.

Leveraging Riders or Additional Benefits

- Explore optional riders such as accelerated death benefits, waiver of premium, or accidental death benefits to enhance your coverage.

- Customize your policy with riders that address specific needs or concerns, such as long-term care or critical illness coverage.

- Understand the costs and benefits of each rider to determine if they align with your overall financial plan.

Aligning Your Policy with Financial Goals

- Review your life insurance policy annually to ensure it aligns with your current financial goals, retirement plans, and estate planning objectives.

- Consider adjusting your coverage amount or policy type as your financial situation evolves, such as increasing coverage to match income growth or changing beneficiaries as needed.

- Work with a financial advisor to analyze your policy in the context of your overall wealth management strategy and make informed decisions about your coverage.

Ending Remarks

In conclusion, reviewing your life insurance quote every year is not just a recommended practice, but a necessary one to ensure you have adequate coverage that aligns with your current life circumstances. By staying proactive and informed, you can safeguard your financial future and protect your loved ones in times of need.

Question & Answer Hub

Why is it important to review my life insurance quote annually?

Reviewing your life insurance quote annually allows you to ensure that your coverage meets your current needs and circumstances, helping you avoid being underinsured or overpaying for unnecessary coverage.

How do changes in health, income, or family size impact my insurance needs?

Changes in health, income, or family size can affect your insurance needs by either increasing or decreasing the level of coverage required to adequately protect yourself and your loved ones.

What are the advantages of obtaining quotes from multiple insurance providers?

Obtaining quotes from different providers allows you to compare coverage options, premiums, and policy terms, helping you find the best value for your life insurance needs.

How can I optimize my life insurance coverage?

You can optimize your life insurance coverage by regularly reviewing your policy, considering additional benefits or riders, and ensuring that your coverage aligns with your financial goals.